BIGGEST PROBLEM BUYERS HAVE:

Not certain about their rights! Right after or before you place an offer on a property be sure to contact a Title Insurance professional. If you wait too long, you may find yourself with little choice but to go with the recommendation of your realtor or bank, which will undoubtedly cost you more in closing costs.

Don’t waive your right to choose your own Title Insurance Company. Not all title insurance companies have the same fee structure, regardless of what your realtor or lender might have told you.

You are not obligated to use your real estate agent or lender’s in house company for title insurance.

Avoid getting hit with additional fees at the settlement table by an “in house” operation. Shop around your title insurance just like you do your mortgage! Compare quotes and ask for a complete list of any additional fees in writing. Ask about discounts for which you may be eligible.

When it comes to Mortgage Shopping:

You have the RIGHT

- to shop for the best loan for you and compare the charges of different mortgage brokers and lenders.

- to be informed about the total cost of your loan including the interest rate, points and other fees.

- to ask for a Good Faith Estimate of all loan and settlement charges before you agree to the loan and pay any fees.

- to know what fees are not refundable if you decide to cancel the loan agreement.

- to ask your mortgage broker to explain exactly what the mortgage broker will do for you.

- to know how much the mortgage broker is getting paid by you and the lender for your loan.

- to ask questions about charges and loan terms that you do not understand.

- to a credit decision that is not based on your race, color, religion, national origin, sex, marital status, age, or whether any income is from public assistance.

- to know the reason if your loan was turned down.

- to ask for the HUD settlement cost booklet “Shopping for Your Home Loan”.

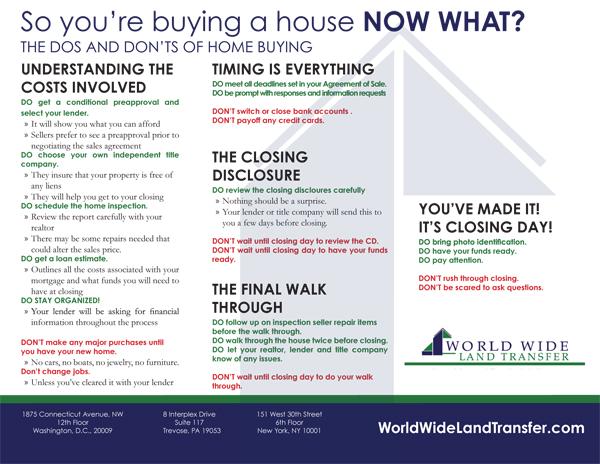

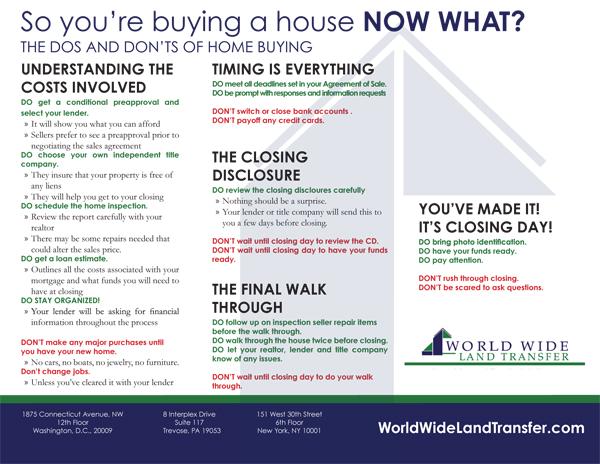

Keys to Guarantee A Smooth Settlement

View this full size PDF