By admin

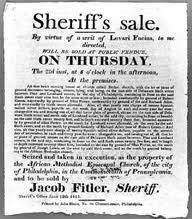

It’s 1:00 a.m. and hubby is snoring so I’m downstairs watching infomercials. “BUY FORECLOSURE PROPERTIES!!!! BUY TAX SALE PROPERTIES!!!! PENNIES ON THE DOLLAR!!!! SPEND THOUSANDS LESS THAN THE HOUSE IS WORTH!!!!!” Wow! I have got to watch this one! Really? Anyone can show up at a sheriff sale, bid on the properties and walk away with a million dollar home for only a few thousand dollars? Count me in! Ah, but wait. As an experienced title insurance agent I know that the reality of trying to ‘steal’ a property at sheriff sale may not get you  arrested, but it may leave you feeling fleeced all the same.

arrested, but it may leave you feeling fleeced all the same.

Anyone with a TV or computer (is there anyone without?) has heard the dire news over the past few years. Record numbers of people who defaulted on their mortgages, not able to pay due to job loss, medical bills or skyrocketing expenses. Others able to pay their mortgage, but unable to pay the ever-increasing real estate taxes on their property. Banks foreclosing due to delinquent mortgages, counties or municipalities foreclosing on the delinquent tax balances. And all of these properties being offered up to the highest bidder at sheriff sales across the country. So should you buy? Maybe. Possibly. It depends.

Each state has its own laws and rules regulating the collection of delinquent mortgages or taxes so I’m only going to generalize here. The most important thing to learn, though, is are you going to be the owner of the property, free and clear of all other liens or issues? If handled properly, a mortgage foreclosure may effectively wipe out any other claims, but only if it was a foreclosure on a first or senior mortgage. Done improperly and you may be stuck with having to fight other creditors in court. Bear in mind that a bank knows what the properties are worth. If they’ve already loaned $100,000 on a property valued at $150,000, they’re not going to let you buy it at sheriff sale for $10,000. But they may let you buy it for $125,000 which is still a bargain.

Properties with delinquent real estate taxes may be offered for sale in stages. Bid and buy early and you may be saddled with all kinds of other outstanding charges, including mortgages that are now your responsibility. Bid and buy later, and you might get the property free and clear. And what happens after the sale and you discover that the former owner is still living there? Be prepared for the cost and effort needed to evict them through the courts.

So what’s the smartest decision you can make if considering foreclosure or tax sale properties? Enlist the aid of reputable title insurance company such as World Wide Land Transfer. An experienced title insurance agent will run a title search before the sheriff sale and provide you with a title commitment (report) letting you know what is currently an issue such as open mortgages, judgments, liens or delinquent taxes. Armed with that bounty of information you can consult with an attorney or research the laws in your state or county to determine if you want to bid. After the sale, depending upon state rules, regulations and underwriting guidelines, we may be able to provide you with an owner’s title insurance policy.

Regardless of what route you choose when buying real estate – outright purchase or sheriff sale – rely upon your Title Insurance Company to make the transaction a success. Those ‘pennies on the dollar’ may not buy you the house, but they might buy you peace of mind in the form of a title insurance policy.

But wait! There’s more! The amazing TURBO COIN SORTER will SORT those pennies for you, COUNT them, WRAP them in sleeves, PREPARE a slip and NOTIFY your bank of a pending deposit. Just kidding…time for bed now.

Leave a Reply