By dev

The Financial Crimes Enforcement Network (FinCEN) issued a 6-month renewal of their Geographic Targeting Order (GTO) on April 29th, 2022 that required title insurance companies to report some transactions in certain jurisdictions. These transactions included all-cash purchases of residential real estate, which have been used in the past to launder money and facilitate other illegal activities. The GTOs are intended to provide data about the persons who initiated these transactions and determine whether or not the money used to make these purchases came from criminal activity.

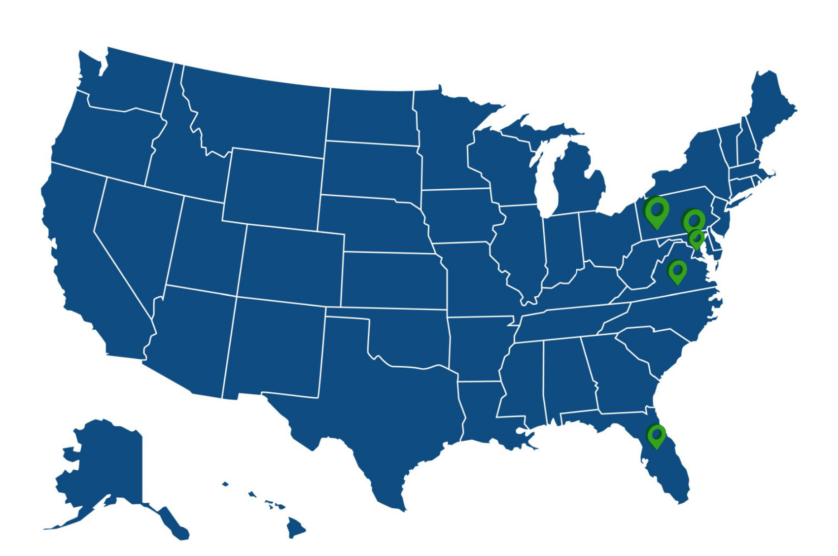

FinCEN’s original GTO issued in April included specific localities across the country from Honolulu to New York City (you can find a complete list here); on October 26th, 2022, they renewed and expanded this order to include locations in Virginia, Maryland, DC, and Florida. If you are a title insurance company in the United States, it is your responsibility to comply with this order. Here is some more specific information about the order and its requirements from the title insurance experts at World Wide Land Transfer:

If you are currently involved in any transactions where all of the following apply, you will be required to report them to FinCEN:

As a title company, we must only report the transaction if all of the conditions listed above apply. If reporting is required the title company does so within 30 days of closing the transaction. The American Land Title Association has prepared a GTO Information Collection Form that demonstrates what information is to be collected.

At World Wide Land Transfer, we applaud FinCEN’s efforts to prevent residential real estate transactions from being used to launder money and we will continue to take all necessary steps to comply with these GTOs. As one of the most trusted title insurance companies in PA and the rest of the northeast, we do business in many of the areas listed in the order, and we hope that FinCEN’s GTOs will prevent real estate transactions from being used to facilitate criminal activity.

If you are a lender, home buyer, or home seller, or you are refinancing and need title insurance services, World Wide Land Transfer is a service-oriented PA title company with offices in Philadelphia, New York, and Washington, D.C. With a record of going above and beyond, we are trusted to close everything from complex commercial transactions to residential refinance and purchase transactions. We can provide a range of title and escrow services for you, so get in touch with us for all your real estate transaction needs.

Check out our blog on the Corporate Transparency Act to learn more today!

Leave a Reply