By admin

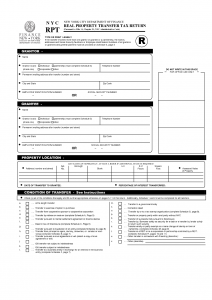

The New York City Registers Office no longer accepts for recording a Real Property Transfer Tax (RPT) return where any of the parties’ tax payer identification numbers are pending. Previously, a newly formed entity with a pending application to the IRS or an alien entity could list on the RPT all 0’s or 9’s since the number has not yet been issued. According to the City Registers Office, this practice is no longer acceptable. New York City Register has adopted new guidelines for the completion and acceptance by the Registers Office of the RPT where only one or no taxpayer identification numbers have been issued.

The New York City Registers Office no longer accepts for recording a Real Property Transfer Tax (RPT) return where any of the parties’ tax payer identification numbers are pending. Previously, a newly formed entity with a pending application to the IRS or an alien entity could list on the RPT all 0’s or 9’s since the number has not yet been issued. According to the City Registers Office, this practice is no longer acceptable. New York City Register has adopted new guidelines for the completion and acceptance by the Registers Office of the RPT where only one or no taxpayer identification numbers have been issued.

Commencing January 5th, 2015, where a return has only one taxpayer identifying number it must be accompanied by an affidavit signed by a party or attorney with the reason there is only one number (number not yet issued- alien entity).

A return where both parties do not have a taxpayer identifying number will require an affidavit for both parties.

At this time there has been no affidavit promulgated. Every affidavit is subject to review by the Register’s Office.

As a NY Title Insurance company we will proof all documentation prior to recording, but it is important to have these affidavits accompany the recording originally as to not delay any recordation.

Leave a Reply